Bank of America

Printed From: Tippmann Paintball

Category: News And Views

Forum Name: Thoughts and Opinions

Forum Description: Got something you need to say?

URL: http://www.tippmannsports.com/forum/wwf77a/forum_posts.asp?TID=189210

Printed Date: 04 February 2026 at 7:26pm

Software Version: Web Wiz Forums 12.04 - http://www.webwizforums.com

Topic: Bank of America

Posted By: impulse418

Subject: Bank of America

Date Posted: 06 October 2011 at 5:02am

|

So there has been a lot of chatter, online, and on the streets. About BofA's controversial, $5 a month fee. Anyone planning on switching to a smaller bank? I feel sorry for businesses, seeing as everyone will opt to choose "credit" on their debit card. |

Replies:

Posted By: choopie911

Date Posted: 06 October 2011 at 5:02am

| So crappy/ dumb |

Posted By: Lightningbolt

Date Posted: 06 October 2011 at 5:59am

| I've done alot of recent work for them in the housing industry. They are losers. |

Posted By: agentwhale007

Date Posted: 06 October 2011 at 8:37am

|

Switching to smaller banks and credit unions might not help. The $5 fee, as well as all the other fees other banks are testing, is from the Durbin Amendment, which largely capped the fees that banks can charge businesses for processing debit card information. It was a good thing for small businesses, as they don't have to pay those fees to the banks anymore. But, because the businesses are not paying anymore, the customer has to pay. In a theoretical world, the businesses would have dropped their prices a certain percentage to match the fees they are no longer paying, but that's not really how our markets work. The larger banks are implementing the fees early to appease share holders and buffer the impact of not collecting those fees from businesses. The credit unions and small banks can probably hold out a lot longer on charging debit card usage fees, because they're either not concerned with profit nearly as much or operating as a not-for-profit, but they'll still have to charge eventually to make up those costs. |

Posted By: jmac3

Date Posted: 06 October 2011 at 9:18am

|

I love my credit union so I don't care I would pay them $5 a month. Especially since they dont charge me anything ever, and participate in SUM ATMs. Meaning no service charge at a bunch of ATMs. Bank of America or citizens? Hell no they suck.

I use my debit as credit anyway since they give me rewards points. ------------- Que pasa?

|

Posted By: ParielIsBack

Date Posted: 06 October 2011 at 10:26am

|

I didn't realize it was directly related to that Whale, although I'd hear it was related to the recent regulatory changes. I would consider a credit union sometime in the future (ie: when I have enough money that it might be worth my time to switch). But right now BoA's massive number of locations is a huge plus since I split my time between Boston and NJ. ------------- BU Engineering 2012 |

Posted By: StormyKnight

Date Posted: 06 October 2011 at 10:37am

|

Bank of America debit card cancelled and accounts closed as of last Monday. Put everything back into my credit union and got my new debit card on Wednesday. Thank you Senator Durbin, douchebag supreme. -------------

|

Posted By: mbro

Date Posted: 06 October 2011 at 11:17am

-------------

Don't blame me, I voted for Kodos. |

Posted By: agentwhale007

Date Posted: 06 October 2011 at 11:52am

Chuck Testa?

I wasn't aware there were "fees" as a part of the regulation, just that banks couldn't charge businesses for debit processing. Then again I haven't read the actual thing so I'm probably wrong.

|

Posted By: mbro

Date Posted: 06 October 2011 at 4:12pm

-------------

Don't blame me, I voted for Kodos. |

Posted By: agentwhale007

Date Posted: 06 October 2011 at 4:46pm

Now I know, half the battle, etc.

|

Posted By: impulse418

Date Posted: 07 October 2011 at 2:30am

|

Posted By: Lightningbolt

Date Posted: 07 October 2011 at 6:13am

|

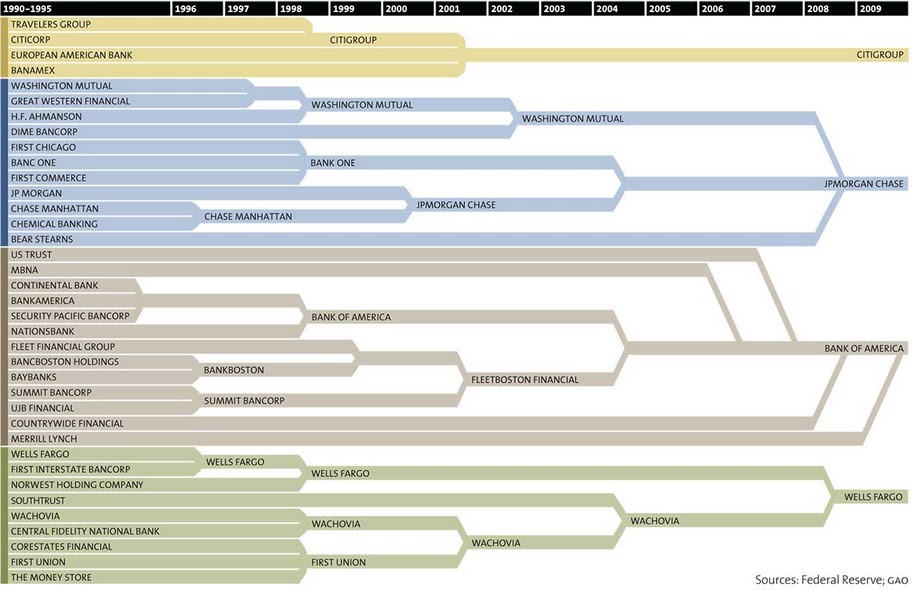

I was in the midst of dealing with Countrywide foreclosures when Bank of America swallowed them up. Thanks for the graph thingy. Very informative |

Posted By: DeTrevni

Date Posted: 07 October 2011 at 6:35am

|

I've got Wells Fargo. No major gripes thus far.

------------- Evil Elvis: "Detrevni is definally like a hillbilly hippy from hell"

|

Posted By: Lightningbolt

Date Posted: 07 October 2011 at 6:47am

|

^you do Wells Fargo foreclosure work? I deal with that bankster too. You would think that these mega banks would have some kind of interest bearing escrow account for us in the foreclosure business as they dig deep into our pockets while we assist them in reducing THEIR massive overhead with OUR money. crooks... I still enjoy doing my personal banking with the local credit union. |

Posted By: Rofl_Mao

Date Posted: 07 October 2011 at 8:10am

|

Posted By: agentwhale007

Date Posted: 07 October 2011 at 9:18am

| I would put all of money money into the First National Bank of Nyah. |

Posted By: tallen702

Date Posted: 07 October 2011 at 4:44pm

| After dealing with two large scale banks that tried every conceivable way (including not adhering to GAAP standards) to screw me out of my money that I had entrusted to them, I went back to banking locally. I've got a live person 24-7 to answer any questions I have. The branch managers have power to take care of virtually ANYTHING without having to go higher up the chain of command, I'm issued a debit card on-the-spot whenever my old one goes bad, or I set up a new account. I'm not charged for their, or any other, ATMs. No minimum balance required, I get VISA rewards for using my debit card, the list goes on and on. |

Posted By: Linus

Date Posted: 07 October 2011 at 5:00pm

|

Just finished switching everything over to USAA (absolutely free checking / savings with no minimums), closed my multiple savings accounts with BoA and will close my checking account after my next direct deposit check arrives, though I hold no balance in the account as of now.

I've had BoA since 2006, never really "screwed over", but it's kind of sad when you judge a bank based off how much you're screwed over. It irks me that I give them my money to hold, they loan it out, and pretty irresponsibly at that, and they pay me back 0.05% for the 'privilege' of letting them use it, plus all the fees they try to push on you. Losing money by keeping it in a bank, really. Like I said, finally switched everything over to USAA... no minimums, no fees, free ATM usage with ATM fees refunded, etc etc. Only thing I'm keeping open with BoA is my credit card which I've had for 5 years and would rather not hurt my credit score by closing my longest credit line. -------------

|

Posted By: deadeye007

Date Posted: 08 October 2011 at 7:08pm

|

I just closed my last account with Wells Fargo last month. They purchased my bank around the same time as the TARP bailout. My bank had free checking, no ATM fees no matter where the card was used, and they had an automated coin counting machine at every branch. My bank also had great customer service. After Wells Fargo bought the bank, those perks disappeared. ------------- Face it guys, common sense is a form of wealth and we're surrounded by poverty.-Strato |

Posted By: impulse418

Date Posted: 14 October 2011 at 2:21am

| http://finance.yahoo.com/banking-budgeting/article/113658/bank-transfer-day-mainstreet?mod=bb-budgeting - http://finance.yahoo.com/banking-budgeting/article/113658/bank-transfer-day-mainstreet?mod=bb-budgeting |

Posted By: impulse418

Date Posted: 01 November 2011 at 7:37pm

|

http://online.wsj.com/article/SB10001424052970204528204577011813902843218.html - http://online.wsj.com/article/SB10001424052970204528204577011813902843218.html Looks like they changed their mind on the debit fee. Too late BofA. Thank god you were able to back those 75 trillion dollars in derivatives already. |

agentwhale007 wrote:

agentwhale007 wrote: